2024 Crypto Investment and Financing Transformation: Decoupling of Primary and Secondary Markets, VC Projects Losing Dominance

Original Article Title: "2024 Crypto Investment and Financing Transformation: Decoupling of Primary and Secondary Markets, VC Projects Losing Dominance"

Original Author: Fu Ruhe, Odaily Planet Daily

In 2024, the heat of cryptocurrency investment and financing decoupled from the overall market trend, with VC coins no longer leading the market performance.

On a macro level, the crypto market witnessed numerous historic moments in 2024, including the launch of Bitcoin spot ETFs, the launch of Ethereum spot ETFs, clarity in regulatory policies of various countries, the Fed's interest rate cut announcement, and the imminent return of Trump to the White House, among other positive macro influences, leading Bitcoin to successfully break through the important $100,000 mark.

Internally in the crypto market, memes became a focal point of market attention, with different types of memes at different times acting as boosters for market rallies. VC projects underperformed, with the linear token release cycle becoming a chronic "poison" for VC projects.

Under the combined influence of these factors, primary market financing saw a significant increase in the number of deals, but the funding amounts were more cautious.

Looking back at the 2024 primary market investment and financing activities, Odaily Planet Daily found:

● The number of primary market financing deals in 2024 was 1295, with a disclosed total funding amount of $9.346 billion;

● The AI sector showed its strength, with a sharp increase in the number of financings in Q4 2024;

● The largest single investment was $525 million for Praxis.

Note: Odaily Planet Daily categorized all projects that disclosed financing in Q1 into 5 major tracks based on dimensions such as business type, target audience, and business model, with the actual close time often preceding the news release: Infrastructure, Applications, Technology Service Providers, Financial Service Providers, and Other Service Providers. Each track is further divided into different subsectors including GameFi, DeFi, NFT, Payments, Wallets, DAO, Layer 1, Cross-chain, and Others, among others.

2024: The Year of BTC and Meme Coins

After reviewing the primary market financing overview of the past three years, a key conclusion is drawn: In 2024, primary market investment and financing activities have gradually decoupled from the overall crypto market trend. The market trend is mainly led by Bitcoin and the meme sector, while traditional VC projects have underperformed and are struggling to remain the core driving force of the market.

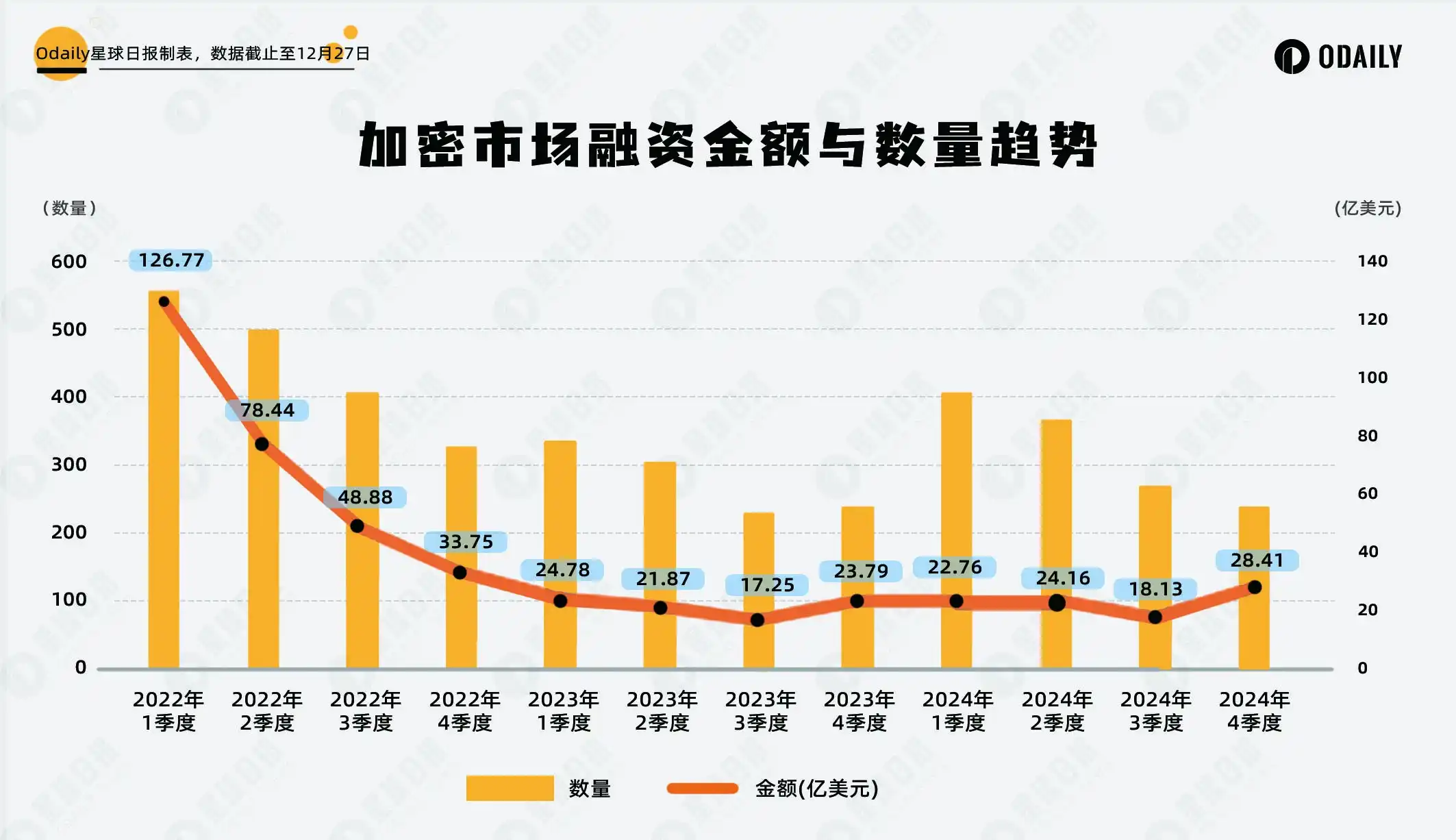

From a data analysis perspective, 2022, as the peak of the previous crypto market cycle, saw highly active primary market financing activities, with the changes in both quantity and amount almost synchronized with the market trends. In the first quarter of 2022, the number of financings reached 562, with an amount as high as $12.677 billion. However, as the market entered a downturn phase, financing activities quickly contracted, with the number of financings reduced to only 330 in the fourth quarter and the amount decreasing to $3.375 billion.

2023 continued the bear market effect, with primary market financing activities and the overall market performing poorly. The number and amount of financings continued to decline throughout the year, reaching 232 deals and $1.725 billion in the third quarter, marking a nearly three-year low. During this phase, the primary market was significantly influenced by the overall market trends, with market sentiment and capital activity both being suppressed.

2024 emerged as a significant turning point for primary market investment and financing activities. Data shows a significant rebound in the number of financings, such as reaching 411 deals in the first quarter, representing an almost 69% increase from the fourth quarter of 2023. However, in contrast to the rebound in the number of financings, the amount of financing exhibited a cautious performance, hovering between $1.8 billion and $2.8 billion quarterly throughout the year. This indicates that despite the recovery in capital activity, investors are more conservative in their fund allocations, further highlighting the decoupling nature between the primary market and the overall market.

Looking at the market heat distribution, the 2024 crypto market was dominated by Bitcoin and meme sectors, in stark contrast to the performance in the previous cycle. In the previous cycle, VC projects were typically at the core of market hotspots, while in 2024, VC projects underperformed overall, making it difficult to substantially impact the market. This phenomenon caused the primary market trends to lose their value as a reference indicator for the overall market.

The primary market in 2024 demonstrated a trend towards rationality and independence. After experiencing the frenzy of 2022 and the winter of 2023, investors are evidently more cautious, focusing more on the actual quality and long-term value of projects rather than blindly chasing market hotspots. This shift may indicate that the primary market is gradually moving away from the traditional crypto market cycle into a new phase of development.

Behind the increase in the number of financings and the cautious amount lies the reflection of VC institutions leaning towards diversification and adopting a more conservative approach to capital allocation. This attitude suggests that the return of market heat has not led to a massive influx of capital but has instead prompted investors to pay more attention to projects with real potential. In other words, the primary market is no longer just a "follower" of trends but is starting to play a role in shaping the future market landscape.

In 2024, the number of primary market financings was 1295, with a disclosed total financing amount of 9.346 billion US dollars

According to Odaily Star Daily's incomplete statistics, in 2024, a total of 1295 financing events occurred in the global crypto market (excluding fund-raising and M&A), with a disclosed total amount of 9.346 billion US dollars, distributed across the infrastructure, technology service providers, financial service providers, application, and other service provider tracks, with the application track receiving the most financing, totaling 606 transactions; the infrastructure track received the most funding, with a funding amount of 3.976 billion US dollars. Both lead other tracks in terms of funding amount and quantity.

From the above chart, the application track, as the sector in the crypto industry closest to end-users, has always been the focus of the primary market. In 2024, the application track's financing performance achieved double-digit growth compared to 2023, with both the number and amount of financing increasing by about 20% year-on-year.

In 2024, the financing performance of the infrastructure track was particularly eye-catching. Both the number and amount of financing saw significant increases compared to 2023, with growth rates exceeding 50%. Behind this growth is not only the continuous demand of the crypto industry for technological infrastructure upgrades, but also the rise of emerging fields such as AI (Artificial Intelligence) and DePIN (Decentralized IoT Network), bringing fresh development opportunities to the infrastructure track.

Overall, the investment and financing activities in the global crypto market in 2024 show distinct characteristics, with the application track and infrastructure track leading in both quantity and amount, indicating a dual demand in the market for end-user experience and underlying technological upgrades. Meanwhile, the technology service provider, financial service provider, and other service provider tracks are brewing new opportunities for stable development, especially the financial service provider track, which is poised for a breakthrough in 2025 with the entry of mainstream finance.

AI Sector Shines, Sharp Increase in Q4 2024 Financings

According to Odaily Star Daily's incomplete statistics, in 2024, financing events in sub-sectors were concentrated in DeFi, underlying infrastructure, and gaming, with the DeFi track having 289 transactions, the underlying infrastructure track having 236 transactions, and the GameFi track having 160 transactions.

Looking at the distribution of financing in sub-sectors:

Looking at the sub-sectors in 2024, the DeFi and underlying infrastructure sectors continue to show steady growth, leading in total funding amount and number of transactions. This indicates that the market's demand for decentralized finance and underlying technology remains strong, with innovations in DeFi protocols and continuous optimization of underlying infrastructure such as multi-chain interoperability and blockchain security becoming the focus of capital attention.

In contrast, the gaming sector performed well in the first three quarters, consistently ranking in the top three in terms of funding amount. However, in the fourth quarter, it experienced a significant decline, with only 29 projects disclosing funding information. This trend reflects a phase of weakening GameFi popularity, with the market becoming more cautious about its short-term profitability and user growth prospects.

Meanwhile, the AI sector's popularity has rapidly surged, becoming a major highlight in 2024. This track often develops in the early stages alongside other fields (such as DeFi and infrastructure) and has not been separately categorized. However, starting from the third quarter, the AI sector has gradually stood out, especially in the fourth quarter, where both the number and amount of funding doubled. The market has shown high interest in the potential application of AI+blockchain, and the emergence of AI Agents has further fueled capital enthusiasm for this track.

The largest single funding amount is Praxis's $525 million

From the Top 10 Funding Amount list in 2024, it can be seen that despite market fluctuations, investment institutions still have strong confidence in infrastructure projects. Almost all of the top ten projects focus on foundational technology and innovation, demonstrating institutions' high expectations for the future development of this track.

L1 public chains continue to attract large-scale funding. In the list, in addition to the veteran public chain Avalanche completing a $250 million private funding round, emerging projects such as Monad, Berachain, and Babylon also demonstrated strong growth momentum. These projects have garnered investor attention through technological innovation and ecosystem expansion.

Praxis is the funding champion on this list, receiving a whopping $525 million investment. However, the specific direction of the project remains relatively unclear, mainly due to its adoption of a DAO organizational form for management, requiring an application to join the DAO, which limits the disclosure of related information.

Notably, Paradigm's dominant position in the list is evident. As a top-tier venture capital firm, Paradigm led the investment in the top three projects on the list—Monad, Farcaster, and Babylon.

You may also like

Giannis Antetokounmpo's Investment in Kalshi Sparks Outrage: Idol Crossover or Insider Trading Scheme?

Mr. Beast Acquires Step: Top Streamer Enters Teen Finance Race?

Not Just Guessing Right or Wrong, Market Prediction Is Getting More and More “Fun”

$55,000 will be Bitcoin's make-or-break level

February 10th Key Market Information Gap, A Must-See! | Alpha Morning Report

About ERC-8004: Everything You Need to Know

ai.com's Debut Flop: After $70 Million Transaction, Did It Get a '504' Timeout?

FedNow versus The Clearing House: Who Will Win the Fed Payments Fray?

Recovering $70,000 in Lost Funds: The "Fragile Logic" Behind Bitcoin's Rebound

Mr. Beast acquires Step, Farcaster Founder Joins Tempo, what are the international crypto circles talking about today?

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…