ETH bulls target $9K: Does the data support the lofty price target?

Ether is gaining momentum as supply constraints, surging demand, and bullish technical indicators converge, with ETH potentially targeting $9,000.

Key takeaways:

- ETH has surged 50% in just two weeks, with Elliott Wave analysis suggesting a possible peak of $9,000 by early 2026.

- Onchain fundamentals remain robust: 28% of ETH is staked, exchange reserves have hit their lowest level since 2016, and new investor inflows are accelerating.

- Despite multiple increases in block gas limits, network usage continues to operate near full capacity, underscoring sustained demand.

After a sluggish market cycle, $ETH’s 50% rally in two weeks has reignited investor interest. Yet, at $3,730, ETH remains 23% below its November 2021 all-time high. Analysts now speculate that its price could more than double from current levels.

Is Ethereum’s biggest rally still ahead? Onchain data, trading activity, and blockchain metrics all indicate that this uptrend may only be in its early stages.

ETH charts signal undervaluation

Despite its strong rally, ETH continues to trail broader market momentum. Glassnode data shows the MVRV Z-score — measuring Ethereum’s market cap against its realized cap (total capital invested) — remains significantly below previous cycle peaks. While ETH has exited the "bearish" zone, it still trades far from levels typically seen at market tops, suggesting room for further upside.

ETH MVRV Z-score. Source: Glassnode

Compared to Bitcoin, ETH remains significantly behind. Over the past year, BTC surged 74% while ETH declined 28%, widening the performance gap. However, BTC’s dominance now sits at historically high levels, suggesting ETH may be under-owned and undervalued. Analysts at Bitcoin Vector note that ETH appears primed for a catch-up rally, potentially signaling an upcoming market rotation.

In the near term, $4,000 serves as a crucial psychological and technical resistance level. A decisive breakout above this threshold could trigger accelerated upward momentum.

From a technical standpoint, Elliott Wave theory—which identifies recurring five-wave price patterns driven by market psychology—suggests ETH is currently in its third impulsive wave. An analysis by XForceGlobal (partially validated but slightly ahead of schedule) projects this phase could propel ETH toward $9,000 by early 2026, assuming supportive macro conditions. If this pattern holds, Ethereum could see a major breakout before the next market correction.

Onchain data confirms ETH's bullish momentum is structural, not just speculative

- Staking demand remains strong: Over 34 million ETH (28% of total supply) remains locked in staking, reducing circulating liquidity and demonstrating long-term holder conviction.

- Exchange reserves hit historic lows: Only 16.2 million ETH sits on exchanges—the smallest balance since 2016. This supply squeeze could amplify upward price pressure as demand increases.

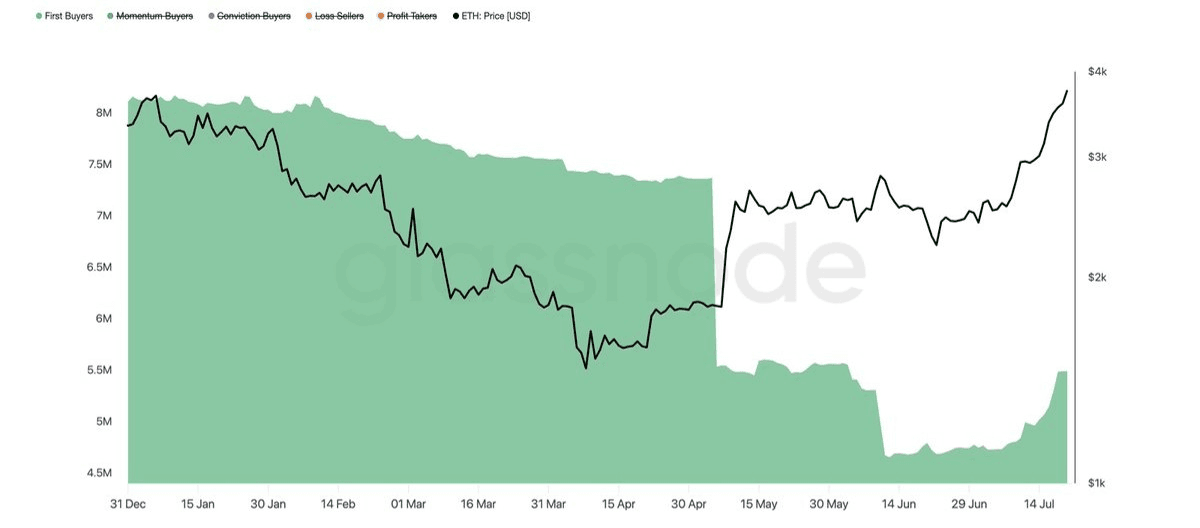

- New buyers are entering the market: Since early July, first-time ETH holders have surged ~16%, signaling renewed retail interest. Glassnode analysts highlight this as the first clear trend reversal in recent months.

These fundamentals suggest ETH's rally is supported by real capital inflows and supply constraints, not just speculative trading. With shrinking liquidity and growing adoption, the setup favors continued upside.

ETH supply by investor behavior: first buyers. Source: Glassnode

Ethereum activity: capacity expands, and demand keeps up

Beyond speculation, Ether’s value depends on actual usage, and that activity is growing in subtle but significant ways.

While average transaction fees have dropped to historic lows—just 0.0004 ETH per transfer—that doesn’t mean Ethereum is quiet. Rather, it reflects improved efficiency, especially with much of the load now handled by layer 2s. To properly gauge demand on the network, fees in ETH can mislead; gas offers a clearer view of the actual computational work being consumed.

You may also like

What is Lumen (LUMEN) Coin

Lumen (LUMEN) has garnered attention as a new and promising player in the crypto market. As of February…

LUMEN USDT Debuts on WEEX: Lumen (LUMEN) Coin Listing

WEEX Exchange is thrilled to announce the listing of Lumen (LUMEN) Coin, opening up exciting trading opportunities in…

What is Yolo (YOLO) Coin?

Yolo (YOLO) is a newly listed cryptocurrency token that exemplifies the high-risk investment philosophy often championed in the…

WEEX Premieres Yolo (YOLO) Coin: YOLO USDT Trading Live

WEEX Exchange is thrilled to announce the world premiere listing of Yolo (YOLO) Coin, inspired by CZ Binance’s…

What is TellrBot (TELLR) Coin?

We’re excited to announce that TellrBot (TELLR) is now available for trading on WEEX. The trading pair TELLR/USDT…

TELLR USDT Exclusive Premiere: TellrBot (TELLR) Coin Debuts on WEEX Feb 9

WEEX Exchange proudly announces the exclusive world premiere listing of TellrBot (TELLR) Coin, a Trusted Autonomous Tokenizer powered…

What is AntiHunter (ANTIHUNTER) Coin?

We’re excited to announce that the trading for the new token pair ANTIHUNTER/USDT is now live on WEEX,…

ANTIHUNTER USDT Premieres on WEEX: AntiHunter Coin Listing

WEEX Exchange is thrilled to announce the world premiere listing of AntiHunter (ANTIHUNTER) Coin, bringing fresh innovation to…

Is XAG a Good Investment in 2026? Analyzing Silver Derivatives for Crypto Traders

As of February 9, 2026, the Silver (Derivatives) token, known as XAG, trades at $81.83 USD with a…

What is XAG Trading? Your Complete Guide to Silver Derivatives in 2026

As we move through early 2026, XAG trading has caught attention with silver derivatives showing a notable uptick.…

Silver Price XAG USD Forecast for 2026: Key Trends and Market Outlook

As of February 9, 2026, the silver price in XAG USD terms has shown notable strength, climbing to…

How to Buy XAUT in 2026: Your Complete Guide to Getting Tether Gold

As we move through 2026, XAUT, also known as Tether Gold, continues to draw attention amid rising gold…

Where to Buy XAUT: Your Guide to Purchasing Tether Gold and Market Insights in 2026

As of February 9, 2026, Tether Gold (XAUT) continues to draw attention amid fluctuating gold prices and growing…

What Is Liora Nuclear Beam ($BEAM) Crypto? Is $BEAM Worth Buying in 2026?

What Is Liora Nuclear Beam ($BEAM) crypto? Is $BEAM worth buying in 2026? This in-depth analysis explains tokenomics, risks, real utility signals, market sentiment, and how to evaluate emerging crypto projects safely in today’s trust-driven market.

WEEX AI Trading Hackathon 2026: How Top AI Strategies Dominated Real Markets

WEEX AI Trading Hackathon demonstrates that effective trading — whether powered by AI or human judgment — relies on core principles: understanding market structure, maintaining conviction, prioritizing quality over quantity, and managing risk intelligently.

Introducing Warden: Complete Guide to $WARD and Airdrop Opportunities

Warden Protocol is a blockchain infrastructure project built to enable the agent economy. Warden enables secure, interoperable AI agents to operate across multiple blockchains, simplifying liquidity, data, and cross-chain access for Web3 developers and users. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 Warden airdrop before Feb.16, 2026!

How to Buy Liora Nuclear Beam (BEAM) Coin? Is It a Good Investment?

Liora Nuclear Beam (BEAM) represents a technological breakthrough in both blockchain implementation and nuclear industry innovation. Operating as a decentralized science (DeSci) protocol built on the Solana blockchain, BEAM establishes an immutable ledger system specifically designed for recording and validating high-energy particle data. Unlike conventional cryptocurrencies that focus on financial transactions, BEAM creates transparent standards for archiving telemetry from particle accelerators, proton therapy systems, and fusion research diagnostic tools.

What is Percolator SOV (PERC) Coin?

Exciting news for crypto enthusiasts: Percolator SOV (PERC) is now available for trading on WEEX, starting February 8,…

What is Lumen (LUMEN) Coin

Lumen (LUMEN) has garnered attention as a new and promising player in the crypto market. As of February…

LUMEN USDT Debuts on WEEX: Lumen (LUMEN) Coin Listing

WEEX Exchange is thrilled to announce the listing of Lumen (LUMEN) Coin, opening up exciting trading opportunities in…

What is Yolo (YOLO) Coin?

Yolo (YOLO) is a newly listed cryptocurrency token that exemplifies the high-risk investment philosophy often championed in the…

WEEX Premieres Yolo (YOLO) Coin: YOLO USDT Trading Live

WEEX Exchange is thrilled to announce the world premiere listing of Yolo (YOLO) Coin, inspired by CZ Binance’s…

What is TellrBot (TELLR) Coin?

We’re excited to announce that TellrBot (TELLR) is now available for trading on WEEX. The trading pair TELLR/USDT…

TELLR USDT Exclusive Premiere: TellrBot (TELLR) Coin Debuts on WEEX Feb 9

WEEX Exchange proudly announces the exclusive world premiere listing of TellrBot (TELLR) Coin, a Trusted Autonomous Tokenizer powered…

Earn

Earn