On-chain Data Academy (Part 5): How Many People Are Actually Making Money? A Five-Minute Overview of the Objective Sentiment Indicator PSIP

Original Article Title: "On-Chain Data Classroom (Part 5): How Many People Are Actually Making Money? A Five-Minute Guide to the Objective Sentiment Indicator PSIP!"

Original Article Author: Mr. Berg, On-Chain Data Analyst

This article is the 5th part of the On-Chain Data Classroom series, with a total of 10 parts. It will take you step by step through understanding on-chain data analysis. Interested readers are welcome to follow this series.

Related Reading: "On-Chain Data Classroom (Part 4): Visualized BTC Chip Price Distribution Chart"

TL;DR

- This article will introduce the on-chain indicator PSIP

- PSIP = Percentage of Supply in Profit, among circulating $BTC

- It can serve as a guide to market sentiment, with applications in recognizing market tops and bottoms

What is PSIP?

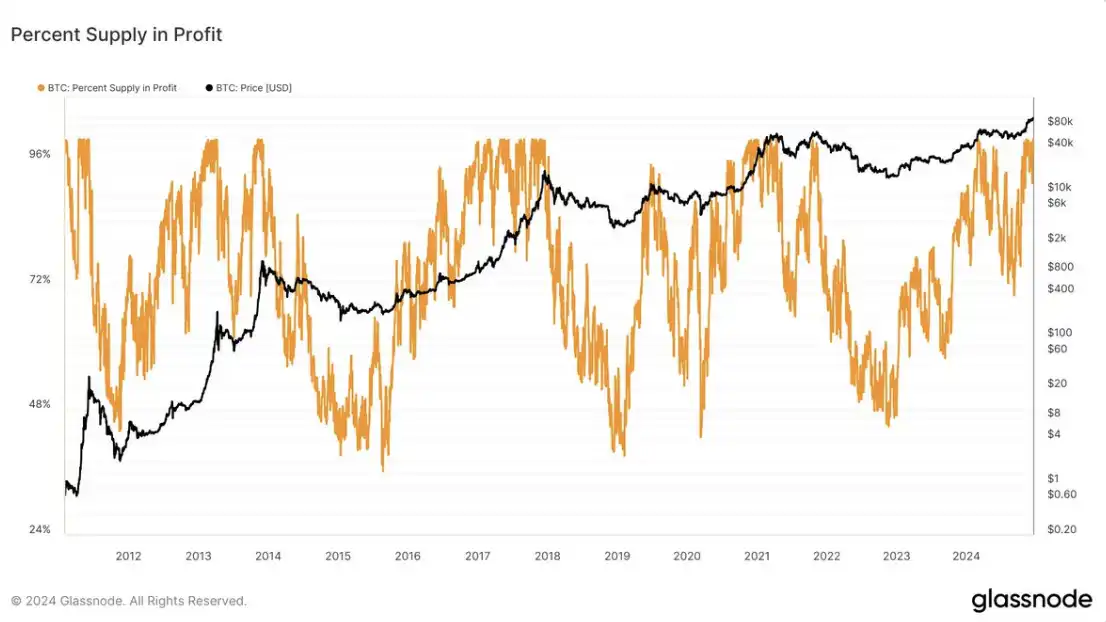

PSIP, short for Percent Supply in Profit, is defined as "the percentage of circulating $BTC that is in a state of profit."

Calculation method:

It distinguishes profit and loss chips by "comparing each $BTC's last transfer price with the current price."

When the current price is higher than a certain $BTC's last transfer price, this $BTC is considered a profit chip.

What if Most Chips Are in a Loss...?

An important application scenario of PSIP is market bottoms. When most chips are in a loss, it is usually a good time to buy the dip.

The logic is straightforward:

Under similar conditions, the more profitable holders, the greater the selling pressure from profit-taking in the market, and vice versa.

As shown in the chart below, historical points where $BTC had PSIP <50% are marked, indicating very precise opportunities to buy the dip

What if the Majority of Chips are in Profit?

As shown in the chart below, the percentage of chips in profit reaches a maximum value of 100%. Therefore, it is difficult to determine a top based solely on high PSIP.

Here is an interesting logic to share: “Observe the Correlation Change between PSIP and Price”

This idea is derived from the following analysis: The Market Pulse – Week 36, 2022

Conclusion

The above is all the content of On-Chain Data School (Part Five). For readers interested in further studying on-chain data analysis, remember to keep track of this series of articles!

If you want to see more analysis and teaching content on on-chain data, feel free to follow my Twitter account (X)!

I hope this article has been helpful to you. Thank you for reading.

You may also like

Gold Plunges Over 4%, Silver Crashes 11%, Stock Market Plummet Triggers Precious Metals Algorithmic Selling Pressure?

Coinbase and Solana make successive moves, Agent economy to become the next big narrative

Aave DAO Wins, But the Game Is Not Over

Coinbase Earnings Call, Latest Developments in Aave Tokenomics Debate, What's Trending in the Global Crypto Community Today?

ICE, the parent company of the NYSE, Goes All In: Index Futures Contracts and Sentiment Prediction Market Tool

On-Chain Options: The Crossroads of DeFi Miners and Traders

How WEEX and LALIGA Redefine Elite Performance

WEEX x LALIGA partnership: Where trading discipline meets football excellence. Discover how WEEX, official regional partner in Hong Kong & Taiwan, brings crypto and sports fans together through shared values of strategy, control, and long-term performance.

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is set to revolutionize cross-border transactions, potentially reaching $5 by the end of Q2 with…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, former co-founder of Multicoin Capital, publicly criticizes Hyperliquid, labeling it a systemic risk. Samani’s…

Leading AI Claude Forecasts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways: XRP’s value is projected to reach $8 by 2026 due to major institutional adoption. Cardano (ADA)…

Bitcoin Price Prediction: Alarming New Research Cautions Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Ready?

Key Takeaways Quantum Threat to Bitcoin: The rise of quantum computing presents a unique security challenge to Bitcoin,…

XRP Price Prediction: Could XRP Ultimately Surpass Bitcoin and Ethereum?

Key Takeaways XRP has maintained a strong position despite a recent 12% drop, suggesting potential for growth. Analyst…

Best Crypto to Buy Now February 6 – XRP, Solana, Bitcoin

Key Takeaways The cryptocurrency market is experiencing pressure due to a technology-sector selloff, affecting digital assets like Bitcoin.…

South Korea Broadens Crypto Market Investigation Following Bithumb’s $44 Billion Bitcoin Error

Key Takeaways South Korea intensifies scrutiny on cryptocurrency exchange operations after Bithumb’s significant Bitcoin transaction error. Regulatory bodies,…

Tom Lee-Supported Bitmine Dominates 3.6% of Ethereum Supply Post-Price Crash

Key Takeaways Bitmine Immersion Technologies now controls 3.6% of Ethereum’s total supply after strategic purchases during market downturns.…

XRP Yearly Returns Hit Record Low Since 2023

Key Takeaways XRP’s yearly returns are at their lowest since 2023, as the crypto market grapples with a…

BTC Traders Eye $50K as Potential Bottom: Key Metrics to Monitor This Week

Key Takeaways Traders are closely monitoring the potential bottom for Bitcoin at $50,000 as recent price movements suggest…

Fraudulent ‘XRP’ Issued Token Sparks Confusion on the XRP Ledger

Key Takeaways An imposter XRP token is causing bewilderment within the XRP community by being superficially identical to…